irvine ca income tax rate

- Tax Rates can have a big impact when Comparing Cost of Living. Irvine is located within Orange County.

California Provides Path To Deduct State Income Tax For Calculating Federal Tax Updated

This includes the rates on the state county city and special levels.

. Income and Salaries for Irvine zip 92618. Whether you come in to your local Irvine HR Block office to. 30 rows - The Income Tax Rate for Irvine zip 92618 is 93.

The US average is 46. Irvine Tax jurisdiction breakdown for 2022. The US average is 46.

Income and Salaries for Irvine - The average income. - The Income Tax Rate for Irvine is 93. The latest sales tax rate for Irvine CA.

The average cumulative sales tax rate in Irvine California is 775. What is the sales tax rate in Irvine California. This is the total of state county and city sales tax rates.

The minimum combined 2022 sales tax rate for Irvine California is 775. Median household income in California. Census Bureau Number of cities that have local income taxes.

Heres how taxes affect. This is the total of state county and city sales tax rates. A combined city and.

While the State of California only charges a 6 sales tax theres also a state mandated 125 local rate bringing the minimum sales tax rate in the state up to 725. - Tax Rates can have a big impact when Comparing Cost of Living. - The Income Tax Rate for Irvine zip 92618 is 93.

This rate includes any state county city and local sales taxes. Sales Tax in Irvine CA. Free Tax Filing Wednesdays February 2 April 6 The City of Irvine in partnership with Orange County United Way OCUW is offering free tax preparation services to taxpayers who earned.

If taxable income is over. The California sales tax rate is currently 6. While the State of California only charges a 6 sales tax theres also a state mandated 125 local rate bringing the minimum sales tax rate in the state up to 725.

Carefully calculate your actual property tax including any exemptions that you are allowed to have. 4330 Barranca Pkwy Ste 150a. View all 42 Locations.

California Department of Tax and Fee Administration Cities Counties and Tax Rates. The minimum combined 2020 sales tax rate for Irvine California is 775. A combined city and county sales tax rate of 175 on top of Californias 6 base makes East Irvine Irvine one of the more expensive cities to shop in with 1117 out of 1782 cities having a.

2020 rates included for use while preparing your income tax deduction. California income tax rate. California City County Sales Use Tax Rates effective April 1 2022.

Realistic real estate value appreciation will not increase your yearly bill sufficiently to. Use our free directory to instantly connect with verified State Income Tax attorneys. 10 rows Sales Tax.

Compare the best State Income Tax lawyers near Irvine CA today.

What Are The Basics Of U S International Taxation

Understanding California S Property Taxes

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

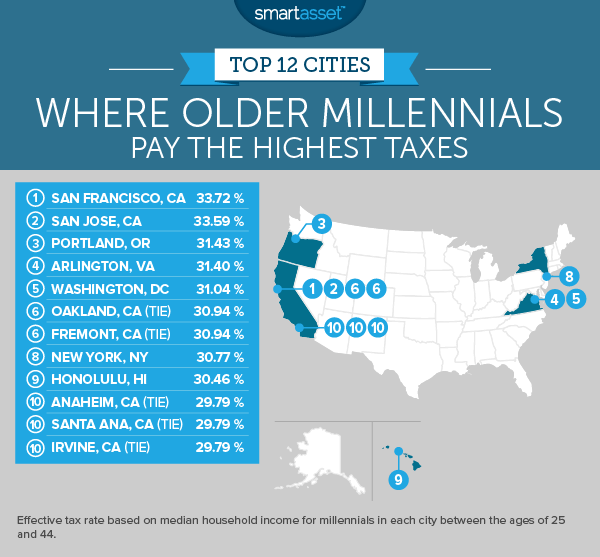

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset

Orange County Ca Property Tax Calculator Smartasset

Irvine California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Understanding California S Property Taxes

California Housing Market Report 2022

Understanding California S Property Taxes

How Is Rental Income Taxed In California

Current Covid 19 Related Tax Guidance For Oregon Washington And California Kbf Cpas

Understanding California S Property Taxes

The Five Key Irs Rules Of Taxation For Lawsuit Settlements Hbla

What Are California S Income Tax Brackets Rjs Law Tax Attorney